Not quite a level playing field

As far as the property market goes, 2015 was dominated by politics. The year started in trepidation of the May election outcome and ended with bewilderment that the supposed best case scenario of an outright Tory victory has proven likely to be more painful than a victory by Ed Miliband’s Labour party.

Taxing times

Despite the Government facing little in terms of true opposition and thus having the supposed freedom to do as they will, the Tory party is far from behaving as one might have expected.

Much is made of the Chancellor’s austerity measures, yet the national debt keeps rising and he flunks the truly tough decisions on welfare etc.

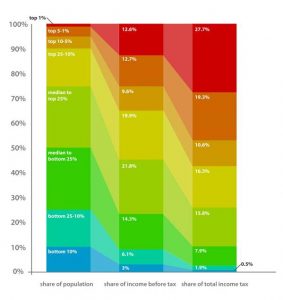

With cuts in spending only able to go so far, it comes as little surprise that the rich (a precise definition open for some debate) would be paying more through increased taxes as illustrated below.

An often quoted statistic is that one third of all income tax is paid by the top 3,000 earners (29.9 million pay income tax in the UK)

When it comes to property, it seems the market is not to be trusted and Government intervention the order of the day with a big slug of wealth redistribution thrown in for good measure.

George Osborne started redefining the rules on property taxes back in 2012 and there has been a seemingly endless list of changes continuing up to today while we await the outcome of a consultation period on the most recent proposals for new levels of Stamp Duty on buy to lets and second homes. The arguments for some changes have been scurrilous and for other more pragmatic and reasonable but in their totality they have posed the biggest risks and challenges to the prime property market, even more so than the inevitability of interest rate rises at some point.

The Tory party above all should recognise that raising taxes often leads to a net drop in revenue to the exchequer. In early December’s autumn statement George Osborne made a bold claim on how he would use increased taxes to fund the construction of desperately needed new housing. At the time Chestertons made the following observation;

Chancellor George Osborne’s plans to generate a revenue surplus and fund the construction of 400,000 new homes,

as announced in today’s Autumn Statement, could be scuppered by the revised Stamp Duty system losing the Treasury

around £3.5 billion over the lifetime of this Parliament. Almost a year on from the introduction of the new Stamp Duty system,

Chestertons experts have calculated the change will cost the Treasury up to £750 million in lost revenue this year alone.

Those with broad shoulders…..

An irritating maxim trotted out by the politicians but the truth is that the richer can afford to pay more and usually do, whereas the middle and lower income groups simply cannot. Prime London property prices have nearly tripled at the very top end over the past 10 years, demonstrating that the wealthy do indeed pay more even as Stamp duty has doubled over that period with most of the increases since 2012. Meanwhile average house prices in the UK are around 20% up (not inflation adjusted) on 2006 based on Nationwide’s average house price index and Stamp Duty remains relatively unchanged at this level.

With top end Stamp Duty rates hitting 10-12%, the wealthy are having to give away more to the Government. However the sum paid at the time of purchase is now similar to the gross fees and taxes in many parts of the world. The introduction of ATED (on properties owned through corporate entities and used for own use now pay around 1% of market value annually) introduces US style property taxation but tends to affect those looking, in the main, to shelter from the mean spirited inheritance tax.

The prime market has certainly been hit by these various changes and transaction volumes were down by around 25% or more last year as a result. However, at the very upper end, £5,000 psf deals appear to be continuing and many truly with the broadest shoulders seem impervious to these tax changes.

Is buy to let being taxed to death?

The motives behind this radical tax overhaul were mainly political at the outset as they were focused on higher value properties in prime markets, a sector unlikely to lose the Tories many votes. More recently the changes have been more pragmatic as the chancellor attempts to influence the broad UK housing market and to some extent deal with the unintended consequences of his earlier moves. Continued tinkering with Stamp Duty (reducing for lower value properties) and giving full access to pension savings which combined to encourage investors and savers to buy up lower cost housing as buy to lets, only led to first time buyers being further disenfranchised in a property market critically short of supply. With Mark Carney voicing his concern of a ballooning and highly leveraged buy to let market and the cries of despair from ‘generation rent’, it would appear that Osborne has set out to significantly deflate a bubble of his own making. To put this sector of the market in to some context, average transactions are circa £180,000 which is more or less the average UK house price (£186,000 according to Land Registry).

The buy to let boom started back in the late 1990’s and few may recall that such loans, typically based on income to service interest only debt, barely existed before around 1997. Lending had historically been extremely limited. Property as an investment performs effectively based on leverage of course and most main stream buy to let investors have used this to the max, often repeatedly refinancing to reinvest. Since the beginning of the millennium interest rates have fallen in quite a spectacular fashion. These highly geared Buy-to-let investors’ have potentially the greatest exposure to rate rises and it is understandable that the Governor of the Bank of England has such concerns which were mirrored in a mid December meeting of the Basel Committee who have advised that banks double the risk weighting on residential buy to let loans.

The removal of interest rate relief is probably the most significant change for the typical buy-to-let investor due to the negative impact on net cash flows.

Shrewd investment in property investment was always as much about sensible debt management as anything else. To ensure a positive cash flow after all outgoings and debt servicing, we revised our target debt : equity ratio down a few years back from 70:30 to 60:40 as yields tumbled. Whether this will need adjusting again remains to be seen but its not too difficult to foresee a more prudent 50:50 ratio in order to achieve an all important neutral position on cash flow . Looking ahead, the continued under supply of housing and the challenges for young professionals to save large deposits will ultimately apply further upward pressure on rents, this in turn should be supported by real wage growth in an improving economic recovery.

Looking ahead we are likely to see corporate investors (expected to be classified as having a minimum 15 properties) enjoying the traditional tax breaks of interest relief etc. as they are withdrawn from individual private landlords and it seems George Osborne is looking to engineer a more professional /institutionalized private rental sector by squeezing out small time investors.

Prime London investors fall less in to BTL category

Our own experience for some while now has seen investors transacting in the prime market with a dual motive. On the one hand the purchase is an investment with both future capital growth and wealth preservation a key consideration but also there is often a secondary motive linked to children’s current or future needs (often starting with schooling) and frequency of time spent in London generally. The buy-to-let element is more often an interim activity until such time the property is required for personal use. These investor/second home owners make up a considerable number of buyers and we see this demand continuing reasonably unchecked.

Despite the Government removing many of the historical tax breaks, ownership of property as a long term investment is likely to remain an attraction for many. The Council of Mortgage Lenders predict the highest number of buy-to-let mortgages this year since 2007 (116,000) but due to the various tax changes they predict this will fall by 22% to 90,000 by 2017. Investors will require more cash as high levels of leverage becomes less attractive and banks tighten lending. In London and elsewhere, where the markets have traditionally attracted high levels of cash buyers or lower leverage, the market is likely to prove more resilient. In the market more broadly, it is unlikely that attempts to deter the nationwide buy to let investor will translate in to a significant market correction as demand remains high with owner occupiers likely to take up any slack from exiting investors and first time buyers supported by the Government’s help to buy schemes.

Could this be the bubble that’s about to burst?

There is one distinct sector of the market which has given us cause for concern over recent years. About the time George Osborne started tinkering with his tax changes back in 2012 we began warning of the rising speculation in the luxury new build sector. As the calls for new housing grew louder house builders responded by developing luxury high end schemes targeted predominantly to overseas buyers who, thanks in part to a significantly weakened sterling and a flight to safety post the GFC, were able to afford and willing to buy £1m plus apartments.

Today, in areas where housing is most needed, there is a critical undersupply of new properties up to £500,000 and a clear and growing over supply of new properties in excess of £1m.

Recently however one of the leading Estate agencies broke ranks to warn of ‘thousands of unbuilt flats bought off plan in luxury new developments’ flooding the market as foreign investors grow disillusioned with the recent tax changes and changing perceptions of future profits. Their head of research notes that ‘up to 60,000 residential properties are due to be finished in 2016 and 2017’. He goes on to say that breaking even would be the best sellers could hope to achieve. It is refreshing to see a selling agent be so candid and relevant to point out that, unlike many leading producers of market research, Cluttons have very few mandates to market these new schemes.

The new build boom, particularly of the past 3 years or so has we feel been built on perceptions of profit as I noted in a previous commentary back in 2013;

Beware perceptions of profit

I met someone recently who bought in the first phase of one of the new schemes in Nine Elms back in 2011 at around £1,000psf. The penultimate phase is being marketed closer to £1,500psf for a comparable unit on a high floor with partial river view. Clearly this implies a healthy return. Notwithstanding buying and selling costs at around 10% the implication is a profit in the order of 40% maybe. However the reality is that barely any second hand market exists as yet and this ‘profit’ is unlikely to be realised. Most buyers for new build are attracted by the down payment & pay later process coupled with easy funding linked to the developer and therefore any new buyers will tend to take this path. Until these projects mature and a genuine second hand market exists, only a few lucky investors are likely to exit with anything approaching an acceptable ROI.

Developers are all too aware of competing stock from earlier phases, indeed Battersea Power Station has a separate sales team to handle the resales. To date the number of project completions has been relatively small but, as noted by Cluttons, this will rapidly accelerate in the next two years. For some, like Malaysian buyers many of whom bought in Phase 1 of Battersea, will find that the cost of their final 80% balloon payment, due the first half of this year, has potentially risen by around 25% or more since they paid their first 10% due to collapses in certain emerging economy currencies.

If these schemes remain so dependent on foreign buyers (as much as 70% has been quoted as the percentage of overseas buyers for luxury new build flats) a perfect storm may be brewing; Increased taxes, rising interest rates and over supply. A fourth element, an appreciating sterling, would surely be the final straw.

Just as the late 1980’s Docklands grand regeneration project took close to a generation to show a genuine return on investment, the potential for these new mega schemes to follow a similar path is clear

Whilst tending to steer clear of these schemes, we are far from negative for the long term. These are indeed likely to be the future just as Canary Wharf eventually proved to be for the commercial sector, as was the initial plan. The likes of Battersea and Earls Court, and even the Olympic Village in Stratford, are windows in to the future and represent the best in terms of planning, design and quality. These meticulously thought through mixed use schemes with their emphasis on integrating work and living space with open parks and new infrastructure with a diminishing emphasis on car ownership are undoubtedly the way for the future. The point is that the ‘future’ equates to a completed or almost completed master plan, with occupied homes, rented offices, profitable retail and buzzy public spaces, let alone a soul that a new neighborhood needs to develop over time. None of this is even close as yet and I would say we are at least 10 years away with a fair amount of pricing adjustment along the way.

A market for identifying and creating value

Prime central London residential property has performed extraordinarily well over the past 20 years. During that time we have seen a mini slump (2000/2001), an extended period of relative stagnation (2001/2004), a ‘blink and you missed it’ crash (Q3 2008 to Q2 2009) and a post crisis boom (2009 -). The brakes are being applied by interference from the Government as opposed to any dynamics of demand and supply.

Those invested are generally well placed to ride out this period of transition and unaffected by the increased Stamp Duty costs of course. Removal of interest rate relief will require a bit more focus on management of gearing and the acceptance that the Government will start to be taking their slice. Corporate ownership and private use may present issues with regards to ATED for some.

For those looking to enter the market, the key will be to identify value and also create value to offset higher entry costs. A soft target for us would be to point out a purchase in a new development where conservatively a 10% premium is typically paid, with Stamp Duty & fees adding up to a further 10% (not to then add on small improvements inevitably incurred and eventual disposal costs) it is easy to see that a buyer can start off in a net deficit well over 20%.

The platinum triangle of Mayfair, Belgravia and Knightsbridge has been very muted this past year and having led the charge we feel is waiting for pricing generally to bed in after a super strong run followed by the various tax changes. The traditional RBKC and Westminster (north & west of St James’s Park) are likely to continue to attract the lion share of interest from the wealthy local and international market. The opportunities to buy well in these otherwise hotly contested locations may well be quite enticing in the months ahead as sentiment for London property remains muted.

Our ethos has always been about adding value. In the 1990’s it was all about refurbishing, refinancing and reinvesting. In the noughties as yields tumbled it was more about utilising gearing and maximising yields through refurbishment. In more recent times we have focused on shorter term profits through development to capitalise on a fast rising market. Looking ahead, the market may not return quite what we have seen these past two decades but whether buying for current or future use or just investment, the key will be to buy well and create value. Buying well means both the rare genuinely good properties that are always so tough to find in a varied market like London and in the right areas (a return to genuine prime central locations), then creating value through a combination of correct entry price and improvements through upgrades and reconfiguration.

WISHING YOU ALL A HAPPY AND PROSPEROUS NEW YEAR

For Clients in the Far East I shall be in the region on the following dates should you wish to meet;

HONG KONG – 19th to 23rd January

SINGAPORE – 24th to 27th January